Compared to THE U.S. INVESTMENT MARKET1

REAL ESTATE VS. OTHER INVESTMENTS2

Nareit analysis of Preqin Real Estate Online data as of December 2020

Rethinking the real estate asset class

Most pension funds that invest in real estate, on an asset weighted basis, invest in real estate using a blend of and private real estate investment.

Real estate is a mature asset class, and like equity and fixed income investments, exposure to real estate can be gained through public market investment as well as through private market investment.

For investors that are considering adding a real estate allocation or are beginning to build their real estate portfolio, REITs generally provide the most cost effective and efficient way to gain exposure to the asset class.

Private Market Investments

“Private market” investments can be thought of generally as investment in real estate through private transactions and vehicles which are not listed on the stock exchange.

Public Market Investments

“Public market” investment generally means investment in real estate by investment in REIT (Real Estate Investment Trust) securities listed on the stock exchanges.

Listen to find out how the City of Austin Employees Retirement System implemented a portfolio completion strategy using REITs:

What is a REIT?

A REIT, or Real Estate Investment Trust, is a company that owns, operates or finances income-producing real estate. REITs provide Americans the chance to own valuable real estate, present the opportunity to access dividend-based income and total returns, and help communities grow, thrive, and revitalize. REITs of all types collectively own more than $3 trillion in gross assets across the U.S. Public REITs own approximately $2 trillion in assets and stock exchange listed REITs have an equity market capitalization of more than $1 trillion.

Investing in both REITs and private real estate investments can be a powerful risk management tool –

historically moderating the likelihood of negative investment returns and providing the opportunity to capture more of the upside in the form of higher returns. Use the slider to see how this could work in your portfolio.

BLEND OF REITS AND PRIVATE REAL ESTATE6

Use the slider to compare various blends

What are the challenges with investing in real estate?

- It is difficult to fully invest in the entire real estate asset class globally.

- As a relatively illiquid asset, it can be challenging to control the real estate investments within a portfolio.

- Investors want to maximize performance while managing investment costs.

- Achieving diversification within the real estate allocation—as part of a risk management strategy—can be difficult.

Read on to find out how REITs can help address portfolio management challenges that face today's real estate investor.

1. It is difficult to fully invest in the entire real estate asset class globally.

REITs enable investors to optimize property and geographic exposures within their real estate allocation, delivering access to traditional “core” property sectors and beyond including hotel, self-storage, healthcare and life sciences sectors; as well as the new economy property sectors like infrastructure, data centers, and networked logistics and industrial properties that support the secular trends toward e-commerce and the digital economy. Today's REIT industry reflects the modern landscape of the real estate asset class.

EVOLUTION OF REIT INDUSTRY: 1993 VS. 20207

2. As a relatively illiquid asset, it can be challenging to control the real estate investments within a portfolio.

Because REITs are real estate companies traded on stock exchanges, they provide real estate investors with effective governance in addition to market liquidity. Market liquidity makes it easier to:

3. Investors want to maximize performance while managing investment costs.

For long-term investors like pension funds, investing in real estate through REITs has provided not only asset class diversification, but also competitive investment performance while preserving purchasing power by outpacing inflation.

REITs' track record of delivering reliable and growing dividends, combined with long-term capital appreciation through stock price increases, has historically provided investors with total returns that are competitive with those of other stocks and higher than most fixed-income investments.

It is important that you and the pension fund staff can understand the implicit and explicit costs of managing the system’s investments. REITs are often the most cost-efficient way for pension funds to invest in the asset class.

Annual net total return and expense by asset class for U.S. Defined Benefit Pension Funds 1998 - 20188

REITs: the strongest performing real estate asset in pension portfolios9

4. Achieving diversification within the real estate allocation—as part of a risk management strategy—can be difficult.

Including real estate as an asset class is a significant step towards building a diversified pension investment portfolio, and an important arrow in the risk management quiver. Real estate is a mature asset class providing investors with an array of opportunities to gain real estate exposure and earn real estate driven investment returns. These opportunities present investors with ways to diversify within the real estate allocation, and therefore, additional tools to manage risk within the real estate portfolio.

REITs are often the most efficient and cost-effective way to access the real estate asset class and offer an important opportunity for investors not only to build their exposure, but also to diversify within their real estate investment program. Whether your plan is new to real estate, or an experienced real estate investor, there are specific benefits of adding a meaningful allocation to REITs.

REAL ESTATE HAS BEEN LESS CORRELATED WITH THE EQUITY MARKET THAN OTHER ALTERNATIVES10

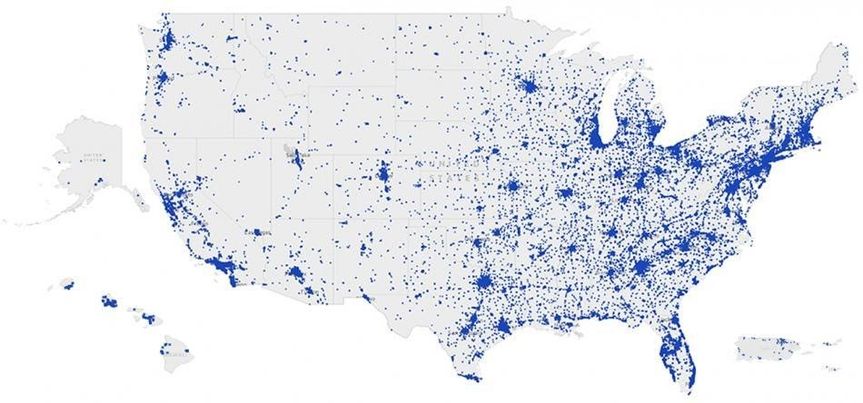

REIT-OWNED PROPERTIES

| Property Type | Number of Properties |

|---|---|

| Retail & Restaurant | 28,454 |

| Telecommunications | 98,080 |

| Multifamily Housing | 4,000 |

| Office | 2,477 |

| Health Care | 8,189 |

| Industrial | 7,292 |

| Property Type | Number of Properties |

|---|---|

| Data Centers | 350 |

| Self-Storage | 6,293 |

| Hotels/Lodging | 1,931 |

| Timberland | 15 M acres |

| Single Family Rental | 134,000 |

| Outdoor Advertising | 209,033 |

Nareit® is the worldwide representative voice for REITs and publicly traded real estate companies with an interest in U.S. real estate and capital markets. Nareit's members are REITs and other businesses throughout the world that own, operate, and finance income-producing real estate, as well as those firms and individuals who advise, study, and service those businesses. National Association of Real Estate Investment Trusts® and Nareit® are registered trademarks of the National Association of Real Estate Investment Trusts (Nareit).

© Copyright 2022 Nareit. All rights reserved.